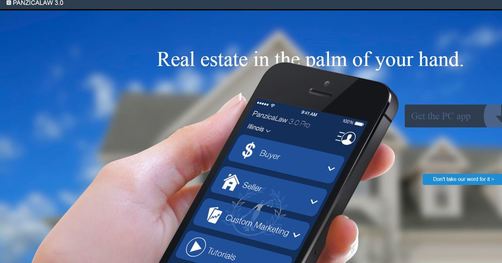

The Law Office of Theresa L. Panzica LLC mainly represents clients that are buying and selling properties. One item that is generally involved in most transactions are transfer stamps, the requirements change from time to time from municipality to municipality, here is the most recent list, visit this link: https://www.cmetro.ctic.com/Uploads/0/FCKUpload/files/Transfer_Tax_List.pdf To easily calculate your transfer stamp liability when purchasing or selling, you may download our new and FREE closing cost app, PanzicaLaw 3.0, by visiting your app store or http://panzicalawapp.com/. Once downloaded, the app will calculate your transfer stamp liability once your municipality is selected. Most times, Sellers are responsible for paying, obtaining, and/or coordinating retrieval of the transfer stamps, sometimes Purchasers are required, sometimes both parties are responsible. Here at the Law Office of Theresa L. Panzica LLC, whether you are buying, selling, or short selling, we assist all with coordination, retrieval, scheduling, payments of transfer stamps--just one less thing that you have to think about when buying or selling a home. If you or someone you know is thinking of buying, selling, short selling, converting or deconverting their building into/from condominiums, please contact us today at 773-539-5970 or emailing [email protected]. Comments are closed.

|

Archives

May 2023

Categories |

RSS Feed

RSS Feed