|

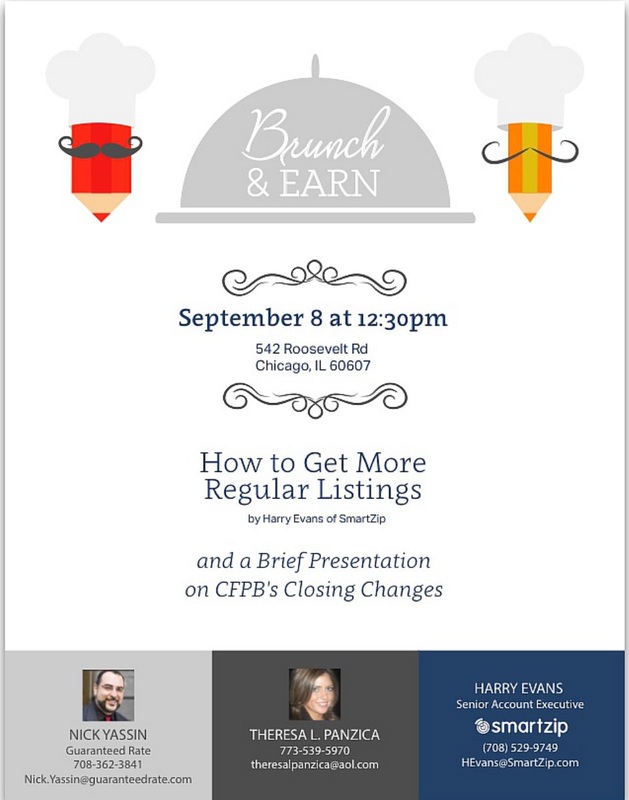

Don't forget to RSVP for our final part of the Brunch and Earn Series, with main presentation by SmartZip, space is limited, RSVP today to [email protected] or at the event link below, see you there.

In Illinois, if you obtain a short sale approval on your home, what should you be looking for in the letter? There are 4 main items to look for, tax, personal, and credit liabilities and seller incentives. Outside of the letter, there are some other items to consider as well.

For more information on short sales or buying or selling your home, please give us a call at 773-539-5970, thank you.  The short answer is this, no. Here at the Law Office of Theresa L. Panzica our clients enjoy short sale processing without paying a retainer or anything upfront to our office. Unfortunately, this is not always standard, most attorney do charge upfront. Week after week, clients come to my office with stories of paying another attorney thousands of dollars with little or no results, don't let this happen to you. Please share this information with your friends, family, co-workers, colleagues, and clients--you can in fact do a short sale without paying first. Underwater, behind on payments, give us a call today for a free consultation and start the process without a retainer or upfront fees, call us 773-539-5970 or email us at [email protected]. |

Archives

May 2023

Categories |

RSS Feed

RSS Feed